Bank of China 2025 Home Loan Promotion: Great News for Refinancing!

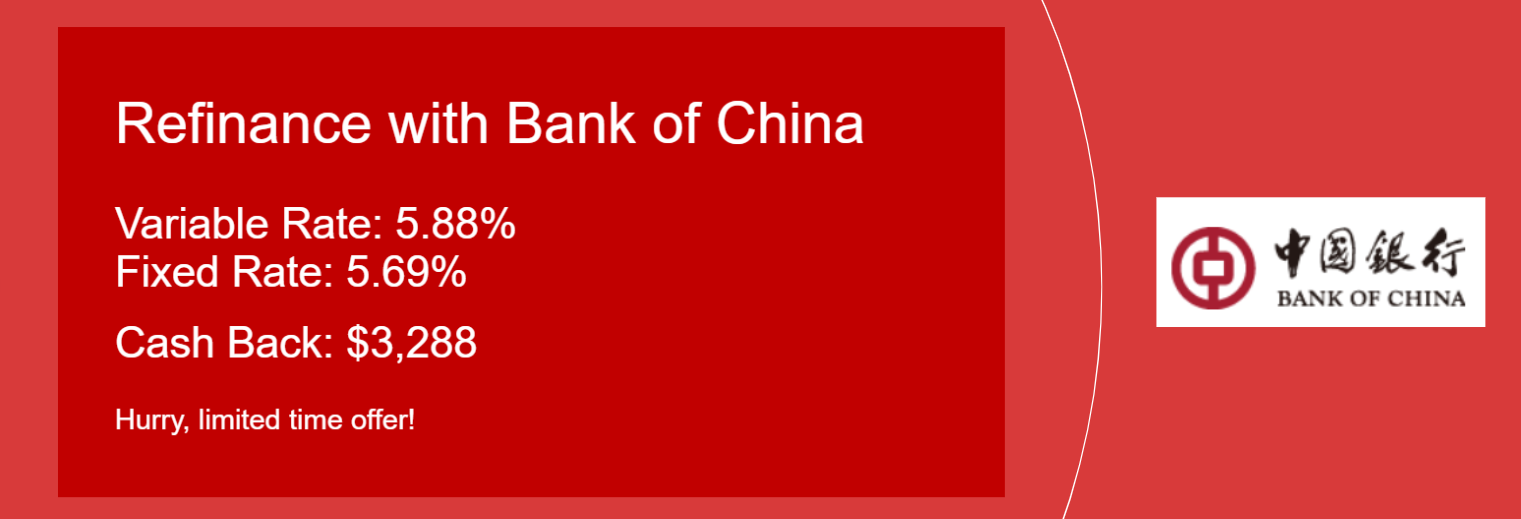

Hello! Today, we’re introducing the new Bank of China (Australia) Home Loan rates and special offers, effective from January 1, 2025. If you’re considering refinancing your loan from another bank, this promotion is full of great opportunities you won’t want to miss. Read on for all the details!

1. Summary of 2025 Changes

- Effective Date: From January 1, 2025

- Owner Occupied 2-3 Year Fixed Rate (P&I): Starting at 5.69% p.a.

- Investment Home Loan (2-3 Year Fixed Rate P&I): Reduced to 5.89% p.a. (-0.10% p.a. cut)

- Discount Plus and Discount Investment Home Loans: Special rates and additional discounts for green borrowers (homes with eco-friendly features)

- Cashback:

- Refinancing: Receive $3,288 per loan

- New Purchases: Receive $2,000 per loan

All offers apply only to “New Home Loans”, so be sure to check the details below for eligibility.

2. Key Interest Rate Information

(1) Discount Plus Owner Occupier Home Loan (Variable Rate, P&I)

- Special Rate: 5.88% p.a. (Comparison rate 6.25% p.a.)

- Green Borrower Rate: 5.78% p.a. (Comparison rate 6.16% p.a.)

A green borrower refers to those who have installed solar panels, solar hot water systems, or heat pump hot water systems on their property.

(2) Discount Investment Home Loan (Interest Only)

- Special Rate: 6.38% p.a. (Comparison rate 6.57% p.a.)

- Green Borrower Rate: 6.28% p.a. (Comparison rate 6.47% p.a.)

Comparison rates are calculated based on a loan amount of $150,000 over 25 years. Actual rates may vary depending on loan amount, term, and fees.

3. Refinancing Benefits: Up to $3,288 Cashback!

One of the most attractive features of Bank of China’s new home loan promotion is the cashback offer.

- Refinancing (from another institution): Receive $3,288 cashback per loan

- New Home Purchase: Receive $2,000 cashback per loan

Additionally, enjoy first-year annual fee waivers, making it a great opportunity for anyone unhappy with their current loan’s interest rate or benefits.

4. Key Terms and Conditions

-

What qualifies as a “New Home Loan”?

A loan for purchasing a property in Australia or refinancing an existing loan from another financial institution to Bank of China. The minimum loan amount is $400,000, and the loan must not include Lenders Mortgage Insurance (LMI). Construction loans are excluded. -

Application Period and Deadline

Applications must be submitted between January 1, 2025, and March 31, 2025, with the loan settled (fully executed) by June 30, 2025. -

Income Requirements

The application must be fully assessed based on Australian-sourced income, with a Loan-to-Value Ratio (LVR) ≤ 80%. -

Cashback Payment Method

Cashback will be credited to a Bank of China (Australia) transaction account (At Call Account) within 60 days of loan settlement. -

Cashback Limitations

Cashback is limited to one per customer (including joint borrowers) within a 12-month period. -

Who qualifies as a green borrower?

Borrowers with homes featuring solar panels, solar hot water systems, or heat pump hot water systems are eligible for an additional 0.1% interest rate discount.

5. Who Should Consider This Promotion?

-

Refinancing Borrowers

If you’ve been monitoring your current loan rate, switching to Bank of China offers lower rates, cashback, and first-year annual fee waivers. It’s a great way to reduce interest costs while securing extra funds ($3,288 cashback) for household expenses. -

Eco-Friendly Homeowners and Buyers

Green borrowers can enjoy an additional 0.1% interest rate discount, making it an attractive option for those investing in sustainable living. -

New Home Buyers

If you’re planning to buy a new home, you can benefit from up to $2,000 cashback and first-year fee waivers, helping reduce upfront costs.

6. Final Thoughts: Don’t Miss This Opportunity

In recent years, with rising interest rates, many borrowers have been looking to refinance for better terms. Bank of China’s 2025 promotion stands out by offering not just lower rates but also direct cash benefits through cashback and green borrower discounts.

Before refinancing, be sure to review any associated fees (e.g., early repayment fees, re-registration costs) to ensure the savings outweigh the costs. Additionally, loan approval and interest rates depend on individual circumstances, such as income, credit score, and property value, so consulting an expert is highly recommended.

If you’d like to learn more about Bank of China’s offers, feel free to contact us for detailed guidance.

Note:

– Specific conditions such as minimum loan amount, LVR, income requirements, and LMI status must be met.

– Comparison rates are based on examples and may vary depending on loan terms and fees.

– Promotion details may change without prior notice during the promotional period, so confirm with us in advance.

We hope this information helps you compare rates and make better financial decisions in 2025!

That’s a wrap on the key points of Bank of China’s 2025 home loan promotion. If you’re considering refinancing, this offer is highly appealing. Be sure to check the conditions and don’t miss this great opportunity. If you have any questions, leave a comment below!

Thank you!