How Refinancing Helped Reduce Monthly Payments and Secure Cash

Hello! Today, we’re sharing a real-life refinancing case that shows how a couple managed to lower their monthly mortgage repayments and even secure extra cash in the process.

First Home Purchase and Initial Loan Terms

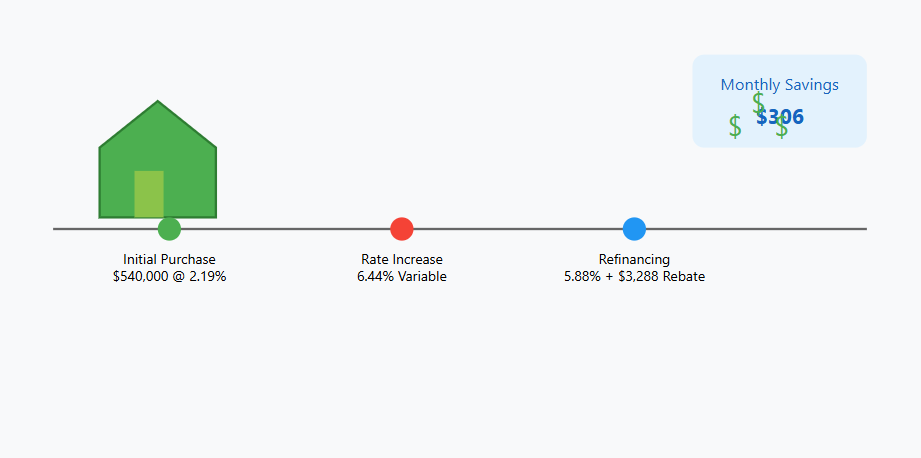

Three years ago, a couple bought their first home for $600,000, securing a 90% loan-to-value ratio and taking out a $540,000 loan. At the time, they enjoyed a low fixed interest rate of 2.19% for two years, with a manageable monthly repayment of $2,048.

The Problem: End of Fixed Rate and Switch to Variable Rate

After the two-year fixed rate ended, their interest rate jumped to 6.44%, causing their monthly repayment to increase significantly to $3,298—an additional $1,250 per month.

Initially, the couple managed the increased cost for a year. However, when the wife became a stay-at-home parent, their household income decreased, and the higher repayments became a major financial burden.

Exploring New Loan Options: Bank of China Offer

While researching refinancing options, the couple discovered an offer from Bank of China. The key details of the offer were as follows:

- Interest Rate: Reduced to 5.88%

- Cash Rebate: $3,288

- Monthly Repayment: Reduced from $3,298 to $2,992, saving $306

The couple was drawn to this offer because it not only lowered their monthly payments but also provided additional benefits.

The Refinancing Process and Results

The couple refinanced with Bank of China, transferring their remaining loan balance of $505,524. Although the refinancing process incurred about $800 in costs, the $3,288 cash rebate from the bank left them with approximately $2,500 in extra cash.

After refinancing, their monthly repayment dropped by $306 to $2,992, resulting in annual savings of about $3,672.

Benefits of Refinancing at a Glance

- Reduced Monthly Payments: From $3,298 to $2,992, saving $306 per month

- Cash Rebate: $3,288 received

- Net Cash After Costs: Approximately $2,500

- Annual Interest Savings: Around $2,830

A Moment of Financial Relief

The couple felt that refinancing not only reduced their monthly payments but also provided extra cash through the cash rebate. With reduced financial stress and some breathing room in their budget, they felt as if they were making money through this decision.

Why Refinancing Matters

This case demonstrates that refinancing is more than just lowering interest rates—it can play a critical role in overall household financial management. During periods of rising interest rates or changes in household income, refinancing to find the best terms is essential.

Take the time to review your current loan situation and see if refinancing could help you secure better terms. Don’t miss out on opportunities like cash rebates or interest rate reductions!

If you found this article helpful, feel free to leave a comment with any questions you may have!