NAB cuts fixed interest rate ahead of RBA decision in major push for Big Four banks, demonstrating a strategic move in response to shifting lending conditions. The bank’s latest change signals its desire to align with market expectations and anticipate future monetary policies. This development highlights the ongoing competition among major financial institutions as they seek to attract and retain borrowers in an evolving economic climate.

Bank Perspective: NAB’s Rate Cut in Context

NAB’s recent decision to lower its fixed interest rate underscores how closely leading financial institutions watch market signals and broader economic trends.

By cutting key lending rates in a climate where borrowers are increasingly cost-conscious, the bank showcases its commitment to staying competitive against rival lenders. This approach reflects a calculated response to shifting consumer behavior, where heightened attention to rate differentials can significantly influence mortgage choices and customer loyalty.

When banks observe movements in global financial markets, they anticipate medium to long-term shifts that could impact their domestic portfolios.

NAB, in particular, has consistently used economic forecasts, consumer sentiment surveys, and regular reviews of its lending products to make data-driven adjustments. Although this latest rate cut stands out as a practical measure to capture a greater market share, it also mirrors the bank’s strategy of setting itself apart through flexibility and targeted offerings.

In essence, NAB’s rate cut responds to a confluence of factors, including ongoing uncertainties in global trade and persistent concerns about the pace of domestic economic recovery.

Furthermore, this change demonstrates the importance of timely responses: institutions that wait too long to match or better competitor moves can lose ground. By retaining a proactive stance, NAB illustrates how financial giants continually strive to balance risk management, customer acquisition, and profitability in an ever-evolving marketplace.

RBA Decision: Potential Implications for Borrowers

The Reserve Bank of Australia’s (RBA) monetary policy decisions carry significant weight across all segments of the financial sector, from large institutions to individual borrowers.

When the RBA is poised to announce any shifts—especially those related to cash rates—banks prepare by adjusting lending strategies ahead of time. NAB’s current move to reduce its fixed rates acts as a beacon for how financial entities might position themselves to take advantage of possible post-decision borrower sentiment.

Many mortgage holders observe the RBA’s announcements before deciding whether to lock in a fixed interest rate or opt for a variable alternative.

A lowered fixed rate can appear particularly attractive if borrowers expect the central bank to implement tightening measures in the near future. This interplay of monetary policy and commercial lending highlights the finely tuned balancing act that institutions must perform, catering to clients’ immediate financial needs while also preparing for potential cost fluctuations.

With a strong possibility that the RBA’s scrutiny of inflation, employment, and consumer spending data will impact its coming decisions, NAB’s proactive rate cut sets a precedent for other large players.

If the RBA tightens or loosens monetary policy, those shifts could either validate or challenge NAB’s approach to retaining existing clients and winning new ones. Reviewing the bank’s latest strategy, observers can see how anticipating central bank actions—rather than merely reacting—helps large lenders remain competitive in a shifting economic landscape.

Big Four Strategies: NAB Leading the Pack

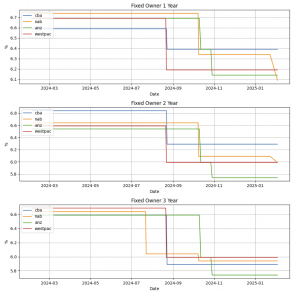

Within Australia’s Big Four, fierce competition often arises when one institution takes a bold step that others may feel compelled to match.

NAB’s recent decision to cut its fixed interest rate is not merely a show of customer-centric benevolence—it also signals the power dynamics at play among Australia’s leading financial entities. Each of the Big Four must consistently refine its offerings to ensure customer retention, all while attempting to undercut or outperform competitors in key market segments.

This dynamic creates a ripple effect across the industry, as customers compare lending terms, scrutinize promotional deals, and look for the most favorable conditions.

Similarly, shareholders and analysts closely examine how each of the major banks responds to economic stimuli like inflation figures, GDP growth rates, and RBA announcements. When NAB steps forward with a strategic rate reduction, it not only aims to fortify its own loan book but also pressures peers to decide whether similar adjustments are necessary to remain relevant.

In a broader context, the Big Four banks collectively shape Australia’s mortgage landscape, influencing housing affordability and consumer confidence.

Amid this overarching competition, NAB’s willingness to lead with a rate cut highlights the importance of agility and responsiveness in today’s market. As borrowers weigh up the offerings and look for signals of stability, proactive movements from major institutions will continue to mold the financial environment, determining where prospective homeowners and refinancers ultimately place their trust.

Conclusion

NAB’s cut to its fixed interest rate, taken in anticipation of the upcoming RBA decision, underscores the ongoing tussle for borrower attention among Australia’s Big Four banks. By positioning itself ahead of potential shifts in monetary policy, NAB hopes to secure a competitive lead and maintain market relevance. For prospective and current borrowers, the rate reduction presents an opportunity to reassess their mortgage choices, explore refinancing, and monitor how other major banks respond to emerging economic signals.

Moving forward, it will be crucial for borrowers to stay informed about RBA announcements and adjust their lending strategies as needed. As the financial landscape evolves, comparing lending products and consulting professional advice can help homeowners and investors make decisions that best suit their long-term financial goals. Ultimately, NAB’s latest move highlights the dynamic nature of the mortgage market, illustrating how targeted strategies can reshape consumer choices in a highly competitive sector.