Australian Economy in 2025: Recovery Expected with Mortgage Rate Cuts

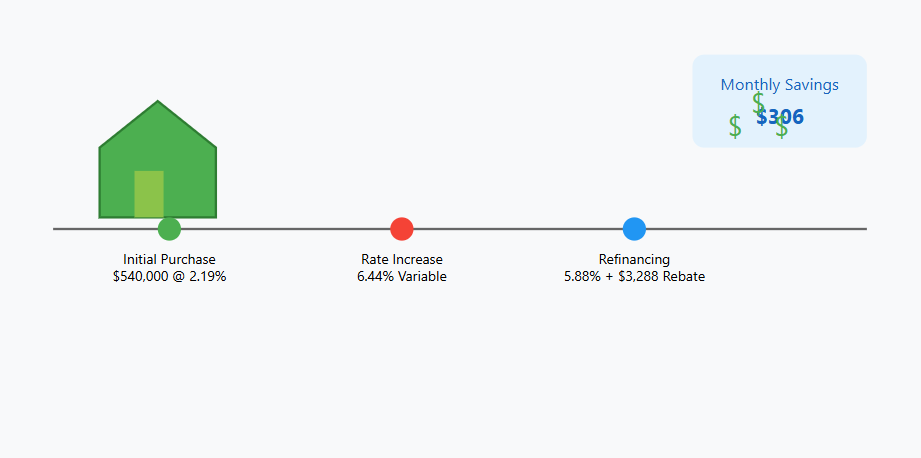

Australian Economy: Recovery Expected with Mortgage Rate Cuts in 2025 After experiencing its slowest growth rate in 33 years outside the COVID-19 pandemic period, the Australian economy is expected to enter a recovery phase in 2025, fueled by mortgage rate cuts. This outlook is based on positive economic forecasts released by Commonwealth Bank and KPMG. … Read more